Case Study

Sarah & James built $327,000 in additional wealth

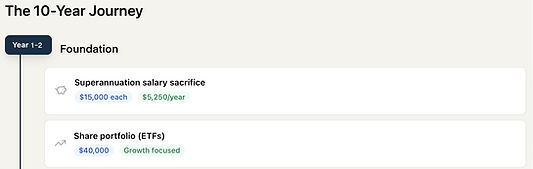

Sarah (35) and James (37), both Melbourne-based professionals earning $105,000 annually, were comfortable financially but wanted to maximise their wealth growth. They had $60,000 in savings sitting in a high-interest account and were contributing the minimum to their super through employer contributions only.

Smart Strategy: 1

Immediate Tax Savings: By contributing additional funds into their superannuation, Sarah and James saved $5,250 in immediate tax savings which would otherwise have been paid to the ATO.

Smart Strategy: 2

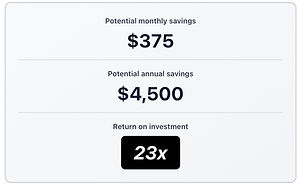

Maternity Leave Planning: When Sarah’s income dropped during maternity leave, they utilised her lower tax bracket to sell investment shares they accumulated over the previous few years. By "income splitting"—moving investment earnings or selling shares with capital gains under her name(instead of James’)—they paid significantly less tax than if James had earned that same income. This optimised their situation to save $3,200 per year.

Example: Sarah invested $40,000 in shares and decides to sell them during her maternity leave. The shares have grown to a value of $55,000. For tax purposes, she sold the shares, creating a $15,000 capital gain. After considering a 50% Capital Gains Tax discount for holding the asset for over a year, her tax payable on the shares was minimal.

If Sarah decides to purchase new shares, her “New” cost base is $55,000.

In the long-term, if Sarah goes back to her $105,000 job and sell her shares five years later for $80,000, she only needs to pay tax on the growth from $55k to $80k.

Learn more about the strategies James and Sarah used in the learning centre.

Annual Income:

We’re handing over the exact, high-performance strategy used to build a 10-year legacy from the ground up.

We show you how to prioritise growth through ETFs, strategically use life changes like maternity leave to lower your tax, and eventually move your wealth into family trusts for ultimate protection.

Whether you’re starting with your first $40k or you’re ready to scale via debt recycling and investment properties, our platform ensures you’re always playing the financial game at the highest level.

Financial Empowerment for All

Get your strategy and start saving today.

- Best Value

Yearly

89$Every year+$9.99 Setup fee1 day free trial- 15 Core Financial Strategies

- Compare strategies to see real savings

- Unlimited access to Luma Calculator

Monthly

32$Every month+$9.99 Setup fee1 day free trial- 15 Core Financial Strategies

- Compare strategies to see real savings

- Unlimited access to Luma Calculator